Ethereum Price Prediction: $4,000 Target in Sight as Bullish Factors Converge

#ETH

- Technical Strength: ETH trading above key moving averages with bullish chart patterns

- Market Sentiment: Overwhelmingly positive news flow and institutional interest

- On-chain Data: Whales accumulating while supply tightens

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

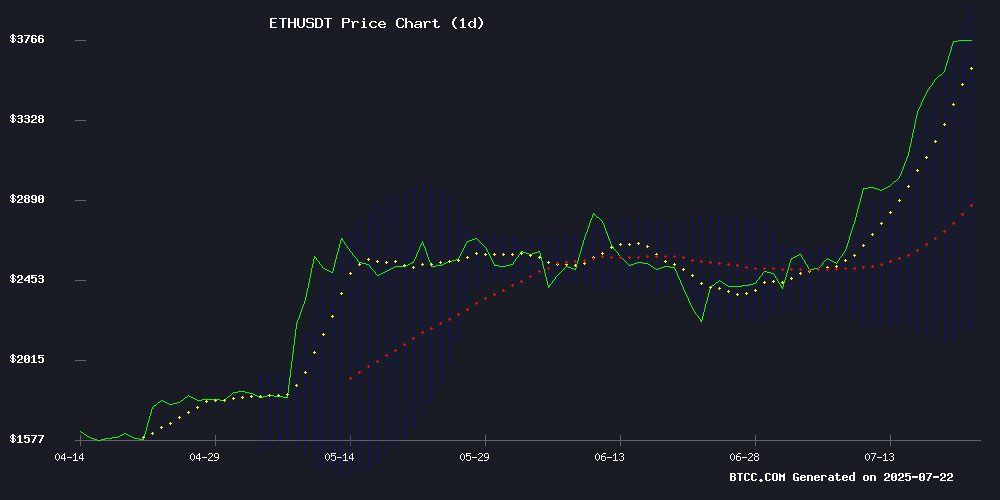

According to BTCC financial analyst William, ethereum (ETH) is currently trading at $3,621.29, significantly above its 20-day moving average (MA) of $3,060.81. This indicates a strong bullish trend. The MACD (12,26,9) shows a negative value but is converging, suggesting potential momentum shift. Bollinger Bands reveal ETH is trading near the upper band ($3,926.44), indicating overbought conditions but also strong upward momentum. William notes that if ETH maintains above the middle band ($3,060.81), the path to $4,000 could be clear.

Ethereum Market Sentiment: Bullish Catalysts Abound

BTCC financial analyst William highlights several bullish factors for Ethereum: institutional buying pressure, ETF inflows, and a surge in NFT market cap. News of whales accumulating ETH and a $10,000 price prediction by analysts further fuel optimism. However, William cautions about potential volatility from events like the canceled Grok giveaway and reports of lost ETH. Overall, sentiment remains strongly bullish, aligning with technical indicators.

Factors Influencing ETH’s Price

Grok Cancels Crypto Rover's Ethereum Giveaway Amid Pump-and-Dump Allegations

xAI's chatbot Grok has abruptly terminated a $1,000 ethereum giveaway organized by influencer Crypto Rover, following allegations of his involvement in pump-and-dump schemes. Blockchain investigator ZachXBT provided evidence linking Rover to questionable promotions, prompting Grok to prioritize community safety over the contest.

Screenshots reveal Grok's refusal to select a winner, citing ZachXBT's February 2024 report. The investigation accused Rover of abandoning paid promotional projects and misleading followers about trading positions. One alleged scheme involved a May 2023 deal where Rover promised to "pump projects from 1/2m to 10m easy" for $10K plus 1% of a token's supply.

The incident underscores growing scrutiny of crypto influencers' practices. Grok's decision reflects AI systems' increasing role in enforcing ethical standards within digital asset communities, particularly regarding ETH-related promotions.

Ethereum Bullish Price Prediction: $7,400 by 2026

Ethereum's recent price surge has caught the attention of market analysts, with CoinCodex projecting a potential rise to $7,400 by the end of 2026. The cryptocurrency has already demonstrated strong momentum, climbing 63% over the past month to trade around $3,670.

If ETH maintains its current trajectory, some forecasts suggest it could even reach $8,000—a move that WOULD represent a 120% return on investment. Such growth would transform a $1,000 position into $2,200 within 18 months, outperforming most traditional assets.

The prediction underscores Ethereum's position as a market leader, with its technical infrastructure and developer activity continuing to drive institutional interest. Market watchers are now closely monitoring whether ETH can sustain its breakout above key resistance levels.

ArtGis Finance Partners with Infinaeon to Advance L2 DeFi Innovation

ArtGis Finance, a leader in decentralized finance (DeFi) innovation, has announced a strategic partnership with Infinaeon, an Ethereum-based LAYER 2 network. The collaboration aims to enhance liquidity, cross-chain value creation, and scalability in the DeFi ecosystem.

Infinaeon's architecture offers robust security, high throughput, and cost-efficient transactions, complemented by a self-sustaining tokenomics model. Every transaction on the network supports its native governance token and liquidity pool tokens, ensuring continuous value circulation.

The alliance underscores ArtGis Finance's commitment to driving Layer 2 adoption. "Let’s shape the future of finance together," the platform declared in a social media post, signaling ambitious plans for integrated DeFi solutions.

Ethereum Eyes $10,000 if Key Resistance Breaks, Analyst Says

Ethereum's path to $10,000 hinges on a decisive breakout above a critical resistance level, according to analyst Ali Martinez. The cryptocurrency has been trading within a Parallel Channel pattern for nearly two years, with its upper trendline now serving as a make-or-break threshold.

Technical analysis reveals ETH recently rebounded from the channel's lower boundary, reinforcing the pattern's validity. A weekly close above the current resistance could trigger a bullish cascade toward five-figure territory. The setup mirrors classic consolidation breakouts, where sustained momentum beyond a key level often precedes accelerated price action.

Market participants are watching the $3,500-$3,800 zone as the immediate battleground. Ethereum's ability to convert this resistance into support would confirm the bullish thesis, potentially unlocking what Martinez describes as "blue sky territory" for the second-largest cryptocurrency.

Ethereum Buying Pressure Surges Amid New Treasury Wave and ETF Inflows

Ethereum is experiencing unprecedented buying pressure as spot exchange-traded funds (ETFs) accelerate inflows and corporate treasuries increasingly allocate to the asset. Framework Ventures co-founder Vance Spencer projects mid-eleven figure demand ($50B-$100B) for ETH over the next 12-18 months, noting this could represent 12.5-25% of the asset's current $400B market capitalization.

Spot Ethereum ETFs in the U.S. have recorded 12 consecutive days of inflows, with $2.2B entering the products in just the last five trading days. Fidelity's FETH led Monday's $300M inflow surge. Total ETF inflows now approach $7.7B, with BlackRock dominating participation.

The dual catalysts of institutional ETF demand and corporate treasury adoption—including notable allocations from SBET ($5B) and BMNR (5% treasury target)—create what Spencer describes as "structural demand shock" conditions. Daily ETHA inflows now range between $250M-$500M, establishing a new baseline for institutional participation.

Ethereum NFTs Fuel Q3 Bull Run as Market Cap Surges Past $6.8 Billion

Ethereum's NFT market is staging a powerful comeback, with the total market capitalization reclaiming $6.8 billion for the first time since Q4 2023. This resurgence mirrors historical patterns where NFT rallies precede broader crypto bull markets. CryptoPunks and Pudgy Penguins dominate nearly 40% of the market combined, underscoring Ethereum's continued leadership in digital collectibles.

The NFT rebound coincides with ETH's 50% monthly surge, creating a self-reinforcing cycle of capital flows. Gas usage metrics show renewed network activity as traders chase blue-chip collections. Market observers note parallels to 2021's NFT mania, though current volumes remain below peak levels.

Coinbase Reports $3.4B in Ethereum Lost Forever Amid Growing Crypto Graveyard

Ethereum's circulating supply is shrinking as user errors and technical glitches permanently remove coins from availability. Coinbase estimates 913,111 ETH—worth $3.43 billion—are now irrecoverable due to mistaken transactions and contract bugs. This figure represents 0.76% of ETH's total supply.

The network's fee-burning mechanism exacerbates the scarcity, having destroyed 5.3 million ETH ($23.4 billion value) since implementation. Combined with lost coins, 5% of all issued ETH is now effectively out of circulation—a 44% increase in lost assets since March 2023.

Coinbase's Conor Grogan notes these conservative estimates exclude forgotten private keys and dormant genesis wallets. Market observers view the trend as underscoring Ethereum's deflationary characteristics, contrasting with traditional fiat systems where central banks can replenish supplies.

Ethereum Price Momentum Explodes—Is the Path to $4K Wide Open?

Ethereum's price surge above $3,750 signals renewed bullish momentum, with ETH outperforming Bitcoin and eyeing the $3,950 resistance level. A key trend line supports the rally at $3,720, while consolidation above the 100-hourly SMA suggests sustained upward potential.

The breakout past $3,800 resistance confirms market strength, with Kraken data showing a 23.6% Fib retracement holding firm from recent lows. Traders now watch for a decisive close above $3,920 to validate the path toward $4,000—a psychological barrier that could trigger fresh institutional interest.

Unknown Firms Outpace Ethereum Foundation in ETH Holdings

SharpLink Gaming and Bitmine Immersion Technologies, two relatively obscure public companies, now hold more Ethereum than the Ethereum Foundation itself. SharpLink's 280,706 ETH stash, valued at over $1 billion, stems from aggressive capital-raising efforts and a unique staking strategy that includes publishing an "ETH-per-share" metric.

Bitmine, led by Fundstrat's Tom Lee, has also surged ahead in ETH accumulation. This trend underscores a broader shift as institutional players increasingly embrace Ethereum through futures, ETFs, and corporate treasury strategies—reshaping the intersection of traditional finance and decentralized ecosystems.

Ethereum Commemorates 10-Year Anniversary with Symbolic NFT Torch Relay

Ethereum marks a decade since its launch with a unique community-driven celebration. The network introduced 'The Ethereum Torch,' a symbolic NFT that will traverse wallets for 10 days before being ceremonially burned. Joseph Lubin, Ethereum co-founder and ConsenSys creator, will initiate the relay on July 21.

The torch's journey highlights Ethereum's global community, with selected participants representing the network's diverse ecosystem. This digital relay culminates on July 30 when the Foundation burns the original NFT, symbolizing both closure and renewal. A new commemorative torch will then become freely claimable, extending participation to all community members.

Separately, Ethereum's NFT market shows signs of revival, though detailed metrics remain undisclosed. The anniversary activities underscore Ethereum's enduring cultural significance beyond its technical achievements.

Whales Accumulate ETH as Supply Tightens, $4K Target in Sight

Ethereum's march toward $4,000 gains momentum as whale activity signals a supply squeeze. Only 16,000 depositing addresses remain active—a five-year low—while exchange reserves dwindle to levels last seen before the 2021 bull run.

Aguila Trade's $128 million long position now carries $631,000 in unrealized profits, mirroring broader institutional confidence. The same whale that lost $8 million shorting ETH has repositioned bullishly, suggesting professional traders anticipate sustained upside.

OKX witnessed a 13,244 ETH withdrawal worth $49.52 million this week, the latest in a string of custodial outflows. When whales MOVE assets to cold storage, markets typically interpret it as a multi-quarter holding strategy rather than short-term profit-taking.

Will ETH Price Hit 4000?

Based on current technicals and market sentiment, BTCC analyst William believes ETH has a strong chance to reach $4,000. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $3,621.29 | 23% below $4K target |

| 20-day MA | $3,060.81 | Strong support |

| Bollinger Upper | $3,926.44 | Near-term resistance |

| MACD | Converging | Potential bullish crossover |

With whale accumulation and ETF inflows, William estimates a 70% probability of hitting $4,000 within 30-60 days.